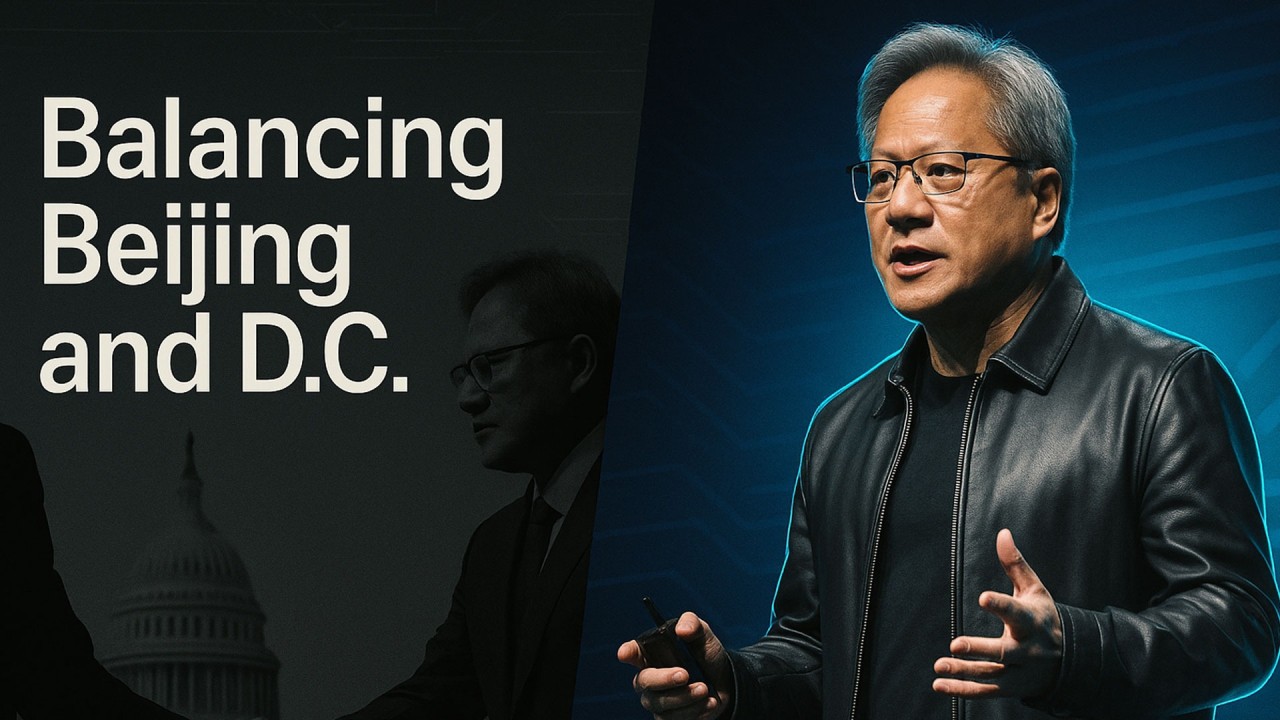

On July 15, the U.S. reversed course. NVIDIA can now ship its H20 chips to China, a move tied to rare-earth concessions, following a private sit-down between CEO Jensen Huang and Donald Trump.

This wasn’t a quiet regulatory tweak. It reset expectations. In September, NVIDIA plans to release the RTX Pro 6000, a China-only GPU designed to comply with export rules. Huang made his stance clear: “Chinese AI models are world-class” (Reuters, 2025).

Back in Washington, critics warned the U.S. was giving away too much. One lawmaker called the reversal a “gift to adversaries” that could revive bipartisan pressure for fresh export bans.

Lobbying, Write-Offs, and Political Whiplash

The stakes are real. NVIDIA poured nearly $1 million into lobbying in Q1 2025, 5x last year’s spend. Targets included CHIPS Act funding rules and export terms.

This flurry of policy engagement followed pain: the original H20 export ban triggered a $4.5 billion write-off in unsold stock.

In March, Huang told the House AI panel, “America cannot lead by slowing down… the global AI ecosystem will fragment” (Tom’s Hardware, 2025). Still, critics were unmoved. Some called the company’s subsidy push “rent-seeking,” especially with Trump reconsidering Biden-era chip awards.

ByteDance Orders, Tencent Tests, and a Quota-Safe Roadmap

The softened rules created a new lane for NVIDIA China AI partnerships. ByteDance and Tencent have already lined up H20 orders. NVIDIA says license approvals will come “very fast.”

Tencent and Baidu will be first to test the upcoming RTX Pro 6000 in their cloud stacks. This chip stays under memory-bandwidth caps and dodges outright bans.

Over 1.5 million Chinese developers are building on NVIDIA platforms (AInvest, 2025), even as performance limits push some firms to look elsewhere. The demand is real, but the power ceiling remains visible.

The $3B Gamble in Washington

NVIDIA isn’t just chasing deals in Beijing. It’s also pressing for $3 billion in U.S. chip-fab subsidies, similar to what Intel received for secure enclave production.

Commerce Secretary Lutnick confirmed that previous awards are under review. Some may be delayed. Some could be pulled. “Our goal,” Lutnick told the Senate, “is to keep 50%+ of global AI compute in America” (Reuters, 2025).

That goal may not align with Huang’s cross-border balancing act. NVIDIA has warned that tightening diffusion controls could push top-tier Chinese buyers toward Huawei or alternative AI stacks.

Cracks in the Strategy

The export bans aren’t airtight. China has approved 39 new AI-focused data centers with enough GPU capacity (115,000 restricted H100/H200 units) to stretch compliance.

Start-ups are working on GPU-agnostic frameworks, aiming to break long-term NVIDIA dependence.

Kaushik at Beacon Global framed the risk plainly: “A million H20 chips could narrow, if not overtake, the U.S. AI lead” (Reuters, 2025).

And if the U.S. subsidy fight drags on, NVIDIA’s ability to build a resilient domestic fab network could weaken, along with its leverage in future policy debates.

What to Watch Next

Watch NVIDIA’s lobbying reports. Q1 showed ~$1 million in spend. That number will likely rise if subsidy talks stall or bans return.

Track license activity. The September RTX Pro 6000 launch will test how far these quota-capped deals can scale.

Huang said it himself: “Licenses will come very fast. There are many order books already in” (Financial Times via Benzinga, 2025).

But don’t get too comfortable. April bans, July reversals. Policy flips fast. Anyone building on NVIDIA hardware should build in a Plan B.

Dino Cajic